Monobank Case Study

The Client

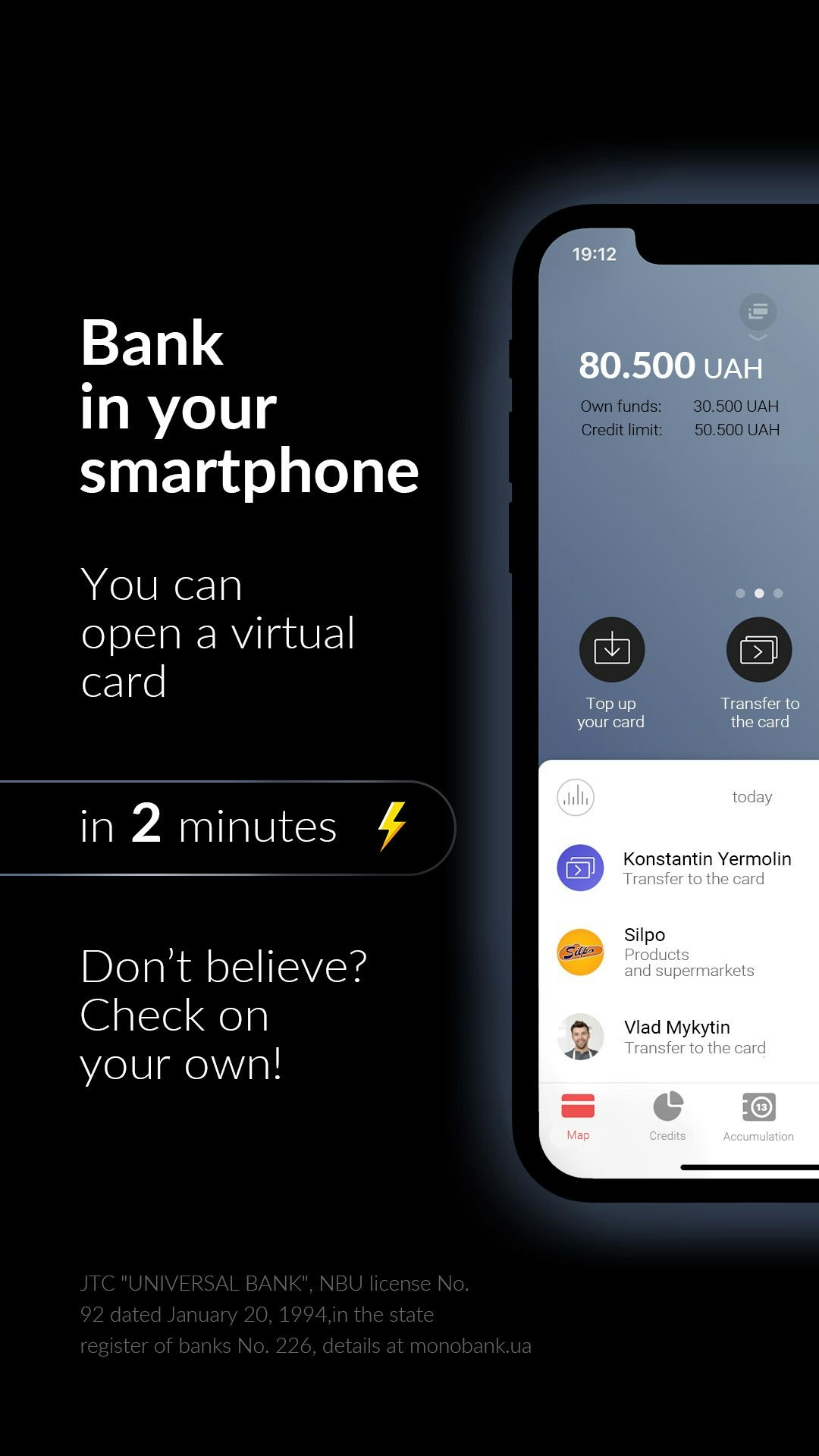

Monobank appears as the first digital-only Ukrainian bank developing the whole bouquet of financial services straight into its user-friendly app. From safe, easy-to-use account management to an innovative service of automatic savings transfers and personalized budgeting tools, Monobank covers all sides of modern big data environment imaging and goes beyond human limitations by providing remarkable efficiency and convenience.

Monobank stands apart because of its principled focus on simplicity and transparency that, coupled with an intuitive user interface, makes customer experience the most crucial element in the created product. The bank has gained a lot of ground with its intuitive interface, easy-to-follow transactions, and customers' adoration for the outstanding 24/7 customer support. This has earned the bank more patronage and made it one of the most beloved banking establishments of its kind by tech-savvy users seeking a frictionless banking experience.

Monobank has successfully merged the futuristic banking technologies, user-oriented design technique, and transparency vision, which, in turn, placed the company at the top of the digital banking industry and set a new level of excellence for others to strive for.

Stage 1

Week 1 - Week 3

Collecting Data & Reaching CPA

Goal

A/B Test, Collect Data & Reach CPA

Task

First of all, we established a key performance indicator (KPI). The monobank team was interested in us attracting users who would issue a credit card. Thus, we agreed on a format for cooperation in CPA, where the event was precisely a credit card issue.

We aimed to attract highly engaged users who regularly use the app's features and are interested in opening a bank card. We tested on platforms such as Facebook and Google and only worked with the Android application.

At the end of our tests, we realized that Google provides a larger volume of users who download, register, and order a bank card. At the first testing stage, we could already give the client a result of 7,000 downloads.

Stage 2

Week 3 - Week 16

Increase The Number of Users, Reach KPI

Goal

Attracting New Users to the Monobank App, increase the number of issued cards

Task

After the testing stage, we focused on a platform such as Google since it was more optimal. Nevertheless, we continued to test different creative approaches on Facebook. Since the client is interested in issuing the card, we needed to increase the volume of users who would download applications, register, and activate the card.

Since the budget was quite limited, our team of buyers used all their knowledge and experience to achieve figures of more than 40,000 downloads. At the same time, the conversion to the card issue was more than 20% of the total number of users who installed the application.

Our team achieved this through a continuous search for new approaches to creating advertisements and testing the most effective ones. Thus, our creative team devised 100 options, which we then analyzed.

Stage 3

Week 16 - Week 28

Growth in the Number of New Users Within the Established KPIs

Goal

Reach new geos, increase the number of issued cards

Task

At this stage of cooperation, we began to launch companies in the Ukrainian geo and worldwide. We also started testing campaigns on TikTok, but Google remains the most effective platform in the Monobank case. During this period, we achieved more than 50,000 installations and issued more than 12,000 cards.

In our ad creatives, we always highlight all the possible advantages and uniqueness of the Monobank. Since, for example, many people already have a monobank app in Ukraine, and many are already using it, we continued looking for the ideal approach to developing working creatives. Despite the challenges, we successfully achieved our objectives and attracted new users.

Sum ups

Our collaboration aimed at attracting users to issue credit cards saw significant success, with over 7,000 downloads achieved in the initial phase. Subsequent efforts focused on increasing user numbers and card issuances, resulting in over 40,000 downloads and a conversion rate of over 20%.

Through global expansion and strategic advertising campaigns, we achieved over 50,000 installations and over 12,000 cards issued, showcasing Monobank's growing prominence in the digital banking landscape. Now we continue to work on this project globally and set even more ambitious goals.